The Greatest Guide To Mortgages Vancouver

Table of Contents3 Simple Techniques For Loans VancouverThe Ultimate Guide To Home Equity Loan VancouverFascination About Home Equity Loans BcThe 6-Second Trick For Home Equity Loan Vancouver

If you are not able to pay the finance back, you may lose your house to foreclosure. Are Home Equity Loans Tax Deductible? The passion paid on a home equity loan can be tax insurance deductible if the profits from the funding are made use of to "buy, construct, or substantially improve" your residence - Home Equity Loans BC.Just How Much Home Equity Car loan Can I get? For well-qualified debtors, the limit of a house equity finance is the amount that obtains the debtor to a consolidated loan-to-value (CLTV) of 90% or less. This suggests the total of the balances on the home loan, any type of existing HELOCs, any type of existing house equity financings, as well as the brand-new house equity finance can not be even more than 90% of the evaluated value of the residence.

You can have both a HELOC as well as a residence equity finance at the exact same time, supplied you have sufficient equity in your home, as well as the income and credit history to obtain accepted for both. The Bottom Line A home equity funding can be a far better choice financially than a HELOC for those that understand precisely just how much equity they need to pull out and also want the protection of a set interest rate.

One of the advantages of homeownership is being able to use the equity in your property as well as use it as security for a financing when money is needed to spend for significant expenses such as residence enhancements or financial debt combination. Funded in a lump amount and repaid over 5 to 30 years at a set passion rate, residence equity lendings can be an excellent selection for these kinds of huge cash needs.

Second Mortgage Vancouver Fundamentals Explained

Here are the pros as well as cons of residence equity lendings. Secret benefits of residence equity financings, Those who obtain house equity fundings may locate there are numerous benefits versus other forms of loaning. Fixed passion, Unlike a residence equity credit line (HELOC), which includes a variable rates of interest that can raise suddenly at any moment, the rates of interest on a residence equity finance is dealt with for the life of the funding."When you get a home equity lending, right from the beginning, you will certainly recognize specifically just how much you'll have to repay every month and what the rate of interest price will certainly be," says Sam Eberts, younger partner with monetary solutions solid Dugan Brown.

Lengthy payment terms, The repayment terms on residence equity fundings can be as long as two decades. This truth, paired with lower rate image source of interest than unprotected finances can translate into a very economical regular monthly repayment installment. Feasible tax-deductible interest, One more potential advantage of house equity loans is the tax write-off.

Certifying for a residence equity lending usually calls for having between 15 percent to 20 percent in equity in your building. A residence equity lending is linked to your home.

Everything about Mortgages Vancouver

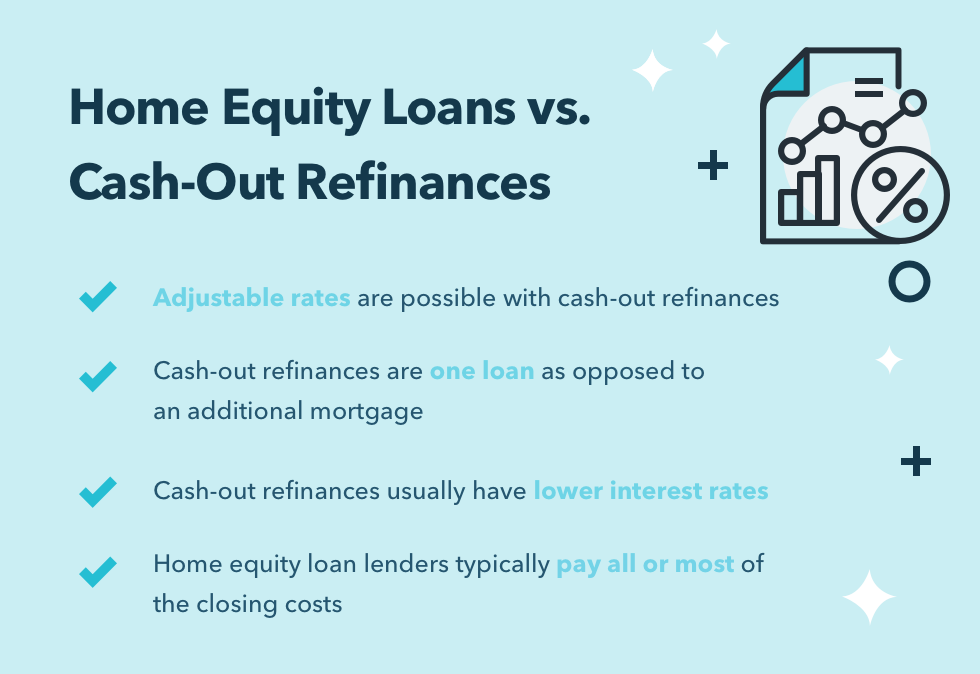

HELOCs, Both a house equity financing and also a house equity credit line (HELOC) use your home as security when obtaining cash. There are also lots of distinctions between these 2 financial items, making it essential to do your research and recognize which one click here for more info is truly ideal for your needs and monetary photo.

Additionally, this alternative features a set rate of interest for the life of the funding and also taken care of regular monthly payments, which can be a safer wager for those on a limited budget."Residence equity lendings give you the security of recognizing your exact month-to-month repayments," claims Sterling, of Georgia's Own. HELOCA HELOC is a rotating credit line comparable to a bank card.

However, you should think meticulously regarding whether you fit using your house as collateral prior to waging this kind of finance remembering that if for some reason you skip, you could lose your home.

The Best Guide To Home Equity Loans Vancouver

Alternatives to a home equity lending, A home equity finance isn't your only choice when you require cash money. The advantage of this path is that you're not dedicating to obtaining the whole sum, so you do not automatically have to start paying interest on it.

Visualize you're taking a look at what you believe will certainly be a $30,000 residence fixing. If you get a $30,000 residence equity lending, you'll get on the hook for interest on that particular whole $30,000. However, if you protect a $30,000 HELOC, but your repair work only end up setting you back $25,000, you'll prevent paying rate of interest on the staying $5,000 news (assuming you do not obtain it for another objective).

You obtain even more than the sum of your impressive residence finance balance. That method, you obtain the distinction in cash and utilize that money as you please., you might take out a new funding worth $180,000 - Mortgages Vancouver.